Why the Helium network is one of the most centralized and most overvalued cryptocurrency

The helium network claims to be “The People’s Network”. This couldn’t be further from the truth. In this document, I’m going to go dive deep into the networks underlying issues.

This is the introduction to their notwork:

“Helium is a global, distributed network of Hotspots that create public, long-range wireless coverage for LoRaWAN-enabled IoT devices. Hotspots produce and are compensated in HNT, the native cryptocurrency of the Helium blockchain. The Helium blockchain is a new, open source, public blockchain created entirely to incentivize the creation of physical, decentralized wireless networks. Today, the Helium blockchain, and its tens of thousands of Hotspots, provide access to the largest LoRaWAN Network in the world.”

1) Validator, staking

Running a validator master node, requires 10000 HNT. On today's price this is 140.000 dollar.

The median worldwide income is 3570 Dollar a year, meaning that half of the population would need to work more than 40 years to be able to afford running a validator node. This practically means that 99% of the population will never be able to afford running a validator.

2) Cost of a miner

Before HIP22 (a change request to the operation of the network ) it was possible to build DIY data concentrators.

The only way to mine Helium is to buy their approved data concentrators. The cheapest concentrator costs around 450USD.

The ROI is very high at the moment, and the electronics industry is experiencing supply chain issues, meaning that the lead time of the miners is around 4–5 months (Or is it? We will see this later.)

3) Cost of a miner, if you would be able to DIY one

https://docs.helium.com/mine-hnt/build-a-packet-forwarder

The link doesn’t work anymore. Helium Inc doesn't want you to build your own miner anymore.

The BOM of such a miner was:

Raspberry Pi 4 35 USD

USBC power adapter 10 USD (generous)

64GB Micro SD card 10 USD

RAK2245 Pi HAT 120 USD (more on this later)

Enclosure 15 USD

As you can see, the approved miners, that are often times have a raspberry pi inside are running 2x-3x the price of the DIY solution

There are other LoRa gateways, available, for similar prices, this one is 98 USD

https://www.seeedstudio.com/LPS8-Indoor-LoRaWAN-Gateway-Included-SX1308-LoRa-Concentrator-p-4251.html

LPS8 Indoor LoRaWAN Gateway (Included SX1308 LoRa Concentrator) — 868MHz

4) Deployment costs

“In order to join the blockchain, every hotspot requires an onboarding code. This code is validated by a staking server and used to onboard a hotspot and pay the $40 staking fee. Currently, these codes are exclusively issued by Helium Inc and validated by their staking server at <staking.helium.foundation>.”

Every hotspot sold needs to have a cryptographic key supplied by Helium Inc, which costs 40 USD. Since generating keys costs nothing, this is 100% overhead and profit.

When I was creating linux single board computers design for a living, the SBC was capable to generate it’s own key in about 1 second after first boot.

5) Open source, built on a closed standard

The helium network is built on the LoRa network. LoRa is a proprietary low-power wide-area network modulation technique. It is developed and maintained by the company Semtech, a fabless semiconductor company.

The LoRa alliance membership costs 10000 USD per year.

Certification of each device must be done with certification body, additionally, you have to pay to the LoRa Alliance.

It’s not possible to certify gateways, only devices.

6) Single source of parts

There are multiple manufacturers for LoRa devices. There is one manufacturer for Lora gateway ICs, Semtech, the IC is the SX1301. The Gateway IC is not licenseable, and there are no second sources for this ICs.

The single IC is priced at 65 USD/each, volume pricing up to 250 pieces is 50 USD. A competing manufacturer, On Semi is selling their AX8052F143–3-TX30 for 2.8 USD. This is not the best priced product that I can find, it is one that I found after 5 minutes of searching.

Semtech is selling their gateway IC at probably a 3000% markup. And there are no second sources.

7) Its all just hot air?

The premise for the helium network is to provide cheap access to the internet for IOT devices.

But how much does it cost to operate a device on the Helium network.

The charging unit is a so-called Data Credit, where 1 USD equals 100.000 DC, or 2.4 MB of data.

A competing IOT solution is NB-IOT and LTE-CAT M1. These technologies have coverage that spans continents, without black spots that is associated with Lora. Companies like 1NCE offer sim cards that have 500MB data included, 10 year availability for a 10 EUR single cost.

This puts 1NCE at 1 USD about 40MB of data, or 1/15th the cost of Helium.

8) Usage of the network

The access to the helium network is only possible though 1 gateway. You have to contact Helium Inc, and let their sales team contact you. This is for something that is called the “The People’s Network”, access to the network is restricted by a company.

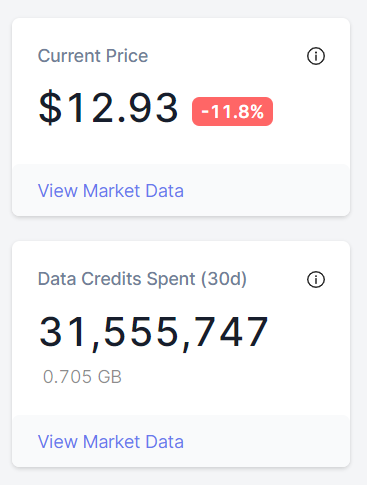

Their blockchain explorer also publicizes their usage statistics, which is for the last 30 days:

32,154,688 DC and 0.719 GB

This equals 321 USD.

Where is all the money coming from?

Some miners are reporting 7–25 HNT per day income, which is 91–350 USD a day.

Helium Inc target is monthly 5000000 HNT minting. This is 70 Million USD on current market price, for a company, that has 321 USD income from data.

Where is all the money coming from?

9) Parts are in stock

Although there is a worldwide semiconductor shortage, due to the extreme markup costs, Semtech can keep their parts being produced. According to Octopart, there are thousands of these ICs on stock.

Other parts of the gateway are not mission critical and an engineer can replace them on a short notice if necessary.

10) Preorder now

Although the miners are not shipping, and you cannot make one yourself, the estimated shipping times of the miners are 3–4 months in the future.

You have to pay the full price for a preorder.

There are approximately 300000 miner on preorder (source: Helium’s Telegram group), which is about 120 M USD.

There have been 40000 hotspots installed, it is unclear how many of these is a miner and how many is older DIY, which doesn't mine anymore.

11) Huge pyramid scheme with nothing underneath

The network usage should grow 200000 times the current usage for the network to support the price of the HNT token.

Or the other way, for 7–25 HNT per day for a miner, and 5 Million HNT minting a month, the realistic price of HNT is 0.0000642 USD.

This probably makes it the most overvalued cryptocurrency (with the possible exception of the “Internet computer”)

12) Security tokens

34% of minted tokens are allocated to Helium Inc, and an unspecified group of people. This is 20 Million USD per month on current rate.

13) Open governance is not open

Joining the Discord server requires phone verification (never seen anything like that).

The proposals are decided by rough consensus, there isn’t a voting process implemented.

14) Trading volume

The 24 hour trading volume of HNT was 41 M USD

Similarly sized coins, FTM had 500M the same day, Ontology had 900M, QTUM 1300M. This probably means that most of the tokens is locked up and not on the exchanges. Helium Inc is likely sitting on most of the supply of the token.

15) Wallet explorer

HNT doesn’t offer wallet explorer or transaction explorer. It is impossible to verify who holds how many tokens.

Validators are supposed to earn very high APRs the website suggests 36% to 360%. Possibly the only reason for this is so Helium Inc. can lock down tokens for an IOU.

16) Where is my money? I want my money!

- Irrational market and possible foul play has driven Helium to #80 on the Coinmarketcap top list, with over 1 billion market cap.

- This is the market cap that is currently generating about 4000 USD a year as useful value.

- Staking costs 140000 USD

- Miners cost x2-x3 their fair value, and they are shipped “in the future”

- The network is highly centralized despite the marketing

17) Most likely scenario happening on the HNT network:

Helium Inc. and partners are using the income from preorders to purchase HNT tokens and artificially inflate the price of the token.

They have no intention to ship you a miner, that has a ROI of days.

There is no business case to support their network, and decided to build a Ponzi scam. It should be called Hydrogen, because the entire network will most likely go out in a bang.

I’ll look at the possibility to build a real open source wireless network, with open consensus, open hardware, fair consensus, without taking 34% of all the tokens to myself.